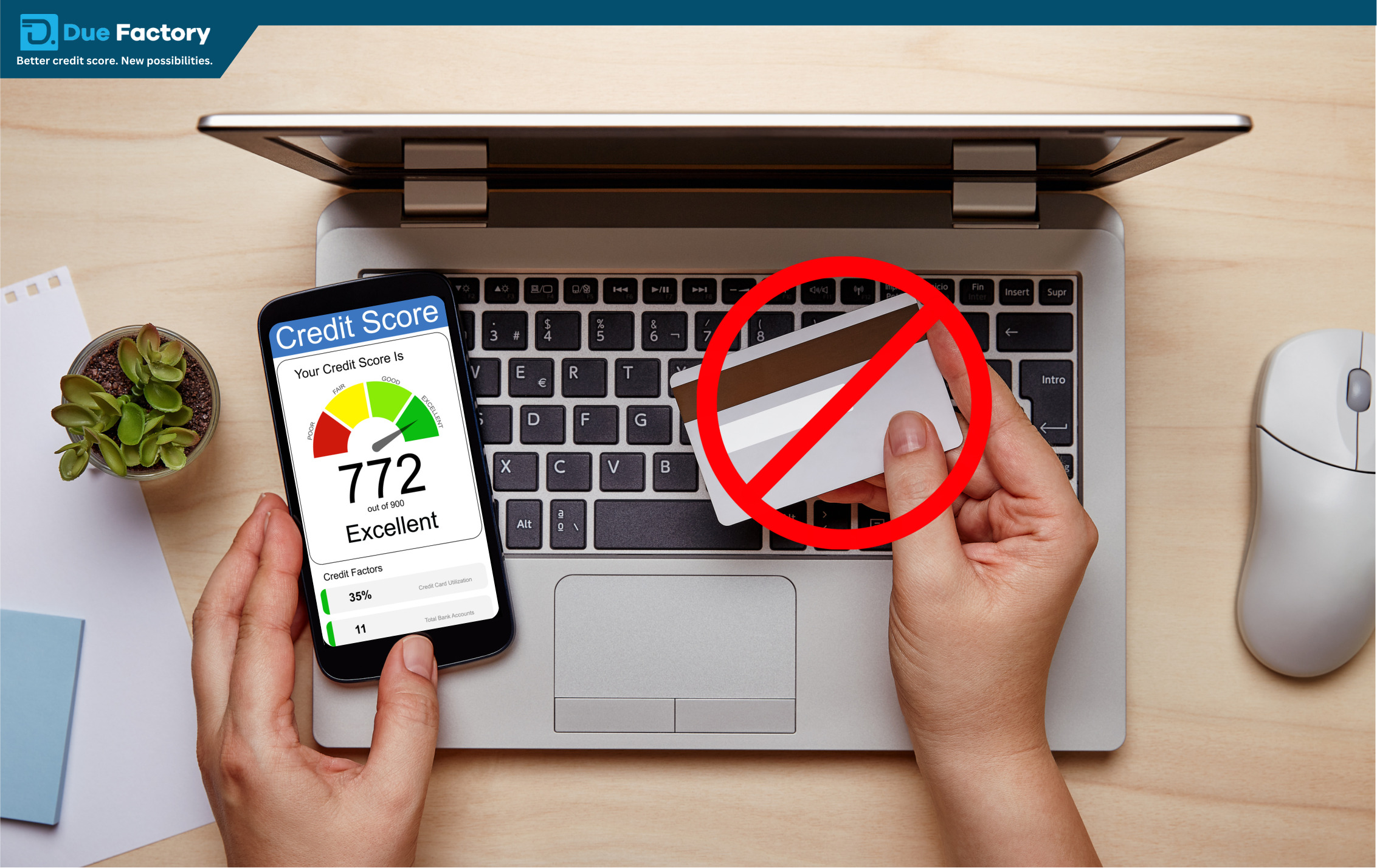

Though using a credit card wisely can help you build a good credit score, it is not the only way to do so. Improving your credit score and making your financial profile more creditworthy can be done without needing a credit card. You can resort to numerous alternatives to build a robust credit bureau score and demonstrate that you can manage your finances efficiently.

Top Tips to Build A Good Credit Score Without Credit Card

Here, we suggest alternate ways or tips to improve your credit health without using a credit card.

1. Take A Small Loan at a Bank or an NBFC

One of the best ways to build a great credit score without a credit card is to borrow a loan from the bank or NBFC. Adjust the loan amount according to your loan repayment capacity. Repaying the dues of the small loan on time can help you build an impressive credit history. However, it is important to note that if you default on your loans and do not make timely repayments, you can have a negative impact on your credit score. Connect with DueFactory, your credit repair partner for the best advice and support.

2. On-Time Repayment

Maintaining good credit history requires making on-time payments of your dues. It is critical to remain cautious and avoid missing your EMI payments. To ensure your credit report does not record any lapses or defaults, be punctual with your monthly payments. The monthly payment includes utilities like electricity, water bills, property taxes, etc., and other outstanding loans. Other loans may include student loans, car loans, creditor builder loans, personal loans, and other secured and unsecured loans.

Missing or delaying these payments may result in a lower credit score, while on-time payments can raise it. Also, ensure a low credit utilization ratio to maintain a good credit score.

3. Peer-To-Peer Lending Loan

Peer-to-peer lending, or P2P lending, is one of the alternative financing methods. This method allows individuals to take loans from other individuals. The individual lenders can be found on the online platforms. If you cannot get a loan from your bank or NBFC due to their lengthy loan approval procedure or eligibility, you can always take one from p2p. These loans may charge a higher interest rate. P2P lending platforms offer you an opportunity to build your credit score as these lending platforms report your payment history to the credit bureaus.

4. Checking your Credit Report

You must get a free report from DueFactory and review the same. A credit report contains a detailed record of your borrowing and repayment history. It has your credit utilization details, credit types used, account balance, late payment details, credit length information, and more. Due Factory, the credit building company, can help you in this regard. You can pull out your credit report free of cost from www.duefactory.com. All these factors determine your credit score. Once you have the report, check all the details like your loan accounts, payment history, pending debts, amount due, etc. Check for any inaccuracy or error in the report, for example, late payment entries paid on time, unknown accounts, outdated information, etc., that might impact your score.

Dispute the same to get the inaccuracies corrected on your credit report. You can write to the credit bureau and highlight the errors. Please provide them with the correct details along with the supporting documents. The bureaus will investigate, verify, and correct the errors, and your credit score will rise.

5. Diversify Your Portfolio

Consider expanding your credit lines including instalment loans like personal loans, home loan, consumer durable loans or loan against property. An ability to manage multiple loans and lines of credit showcases your responsible borrowing behaviour to the lenders. Remember: better the mix of loan lines with an on-time payment history, the higher your credit score.

Wrapping Up

If you follow these methods, you can ensure a good credit score. To positively impact your credit score, take a small loan that you can afford to pay easily, make your payments on time, consider P2P lending, etc. You can also build good credit by not borrowing too much and inculcating other good financial habits.

Disclaimer: This article provides a general guide to the subject matter. You should seek specialist advice about your specific circumstances.

FAQS

1. Can I improve my credit score without having a credit card?

Ans. Yes. You can improve your credit score without having a credit card by taking small loans from banks, NBFCs, or p2p lenders.

2. How can I improve my credit score?

Ans. If you want to improve your credit score without having a credit card, you can take small loans from banks or NBFCs. You can also consider the p2p lending type. You must pay the dues regularly, and pay off other debts.

3. What is the most important thing to build a good credit score?

Ans. Paying your loan EMIs and other bills on time is the most important thing you can do to build a great credit score. Loan lenders report your payment history to the credit bureaus, so making timely payments will help you build a good credit score.

4. How can my financial habits impact my credit score?

Ans. Adopting prudent financial habits can improve your credit score without using a credit card. For example, making timely payments, maintaining a reasonable debt-to-income ratio, keeping the credit utilization ratio low, having a long credit history, and avoiding unnecessary debt can lead to credit improvement.

5. How can I rebuild my credit quickly without having a credit card?

Ans. While credit cards are arguably the best avenues for building credit, they are not the only option for increasing credit scores. Also, remember that rebuilding your credit history may take time. Employing the right strategies and showing responsible behavior can gradually improve your credit score without relying on a credit card.

6. Why do I have a bad credit score even when I don’t have a credit card?

Ans. Credit card history is not the only detail found in the credit report. Other factors, such as loan payment history, keeping a diverse mix of loans and low number of credit enquiries are used in calculating your credit score. Check whether you have defaulted on a loan or your credit report has any errors.